We consume analytics every day at an increasing rate. Most of the time we don't even stop to reflect on the numbers, metrics and statistics that nudge our behavior during the course of our everyday lives.

From Google maps route planning to deal screening and weather forecasts , analytics are the layer of meaning we gloss over the disorder of life.

It may surprise you to learn that broadly speaking they fall into 4 main categories, with a fifth one rapidly emerging as an emerging technology.

This article will focus mainly on the financial analytics that you typically find in a SaaS business, but the concepts contained below are flexible enough to apply to any sort of business model.

What are the 5 types of Analytics?

- Descriptive

- Diagnostic

- Predictive

- Prescriptive

- Cognitive

Let's unpack each one a little to understand their exact value and function as an analytical tool.

Descriptive Analytics:

What is happening in the business?

Diagnostic Analytics:

Why is it happening in the business?

Predictive Analytics:

What might happen in the future?

Prescriptive Analytics:

How can the business avoid future issues?

Cognitive Analytics:

Uses Machine Learning and AI to extract meaning from large data sets. Think Apple's Siri.

Let's take one more step back before we dive in deep to the financial side of things. These might be new concepts to chew on, so let's boil it down to something simpler.

Imagine you were stung by a wasp.

Descriptive:

My hand has a sharp and painful burning sensation. I can't concentrate.

Diagnostic Analytics:

There was a pissed off wasp flying around my ice cream and I tried to make it fly away.

Predictive Analytics:

If I eat ice cream outside, next to a bin full of rotten fruit in August, I might attract the unwanted attention of wasps.

Prescriptive Analytics:

If I don't eat ice cream next to the bin, or choose to eat ice cream next to the bin in April instead, I can avoid these issues. Come to think of it, having looked at the data, I can safely say that I should, in general, just avoid bins full of fruit.

Cognitive Analytics:

Siri, I want a list of all the bins in my hometown.

Investing and lending, when you simplify them, are a lot like not getting stung by a wasp. In both instances, you want to avoid pain, and pay attention to the warning signs of when a company might be heading down the wrong path.

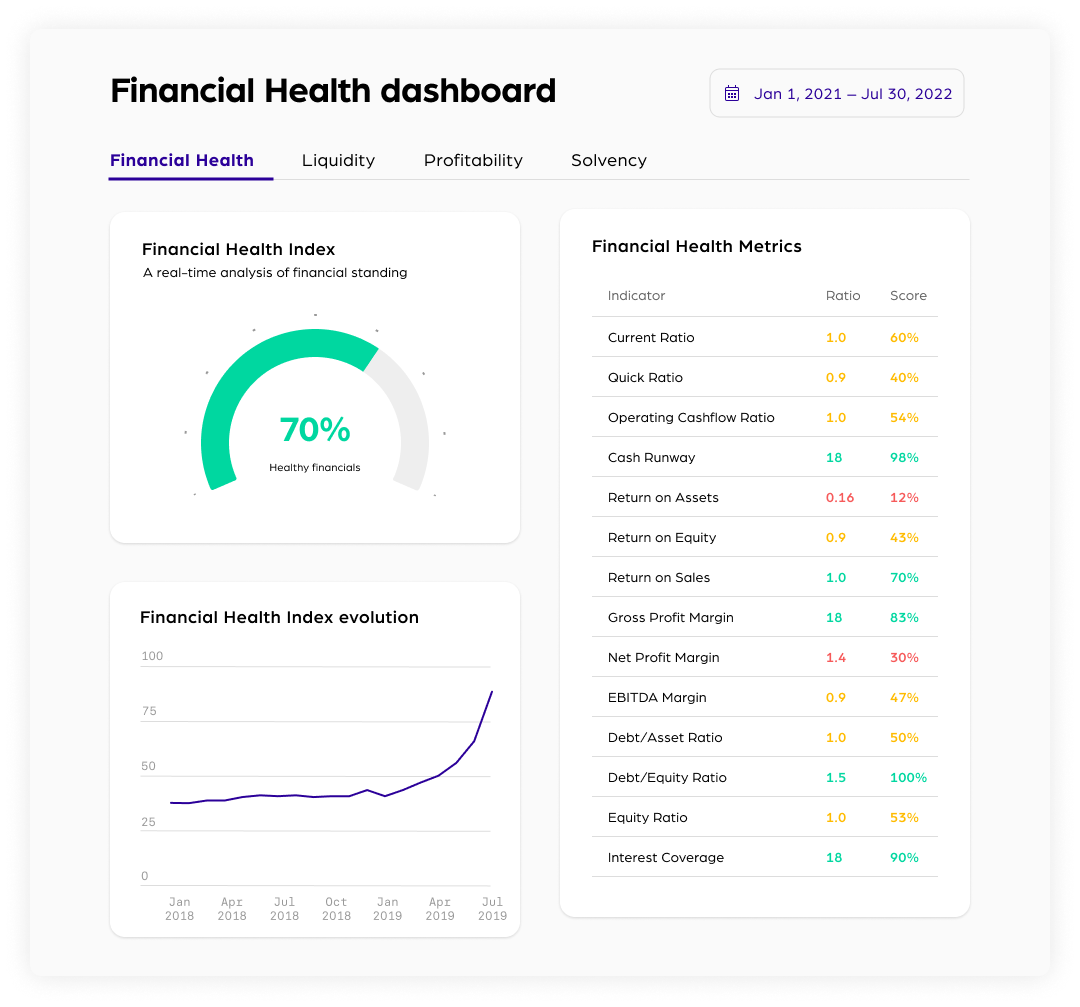

There are a number of Financial KPI’s which can be used to reliably inform you of the financial course of a company. Broadly speaking, they fall into three main categories, Liquidity, Revenue and Profitability.

Descriptive Financial Analytics:

Top line revenue. If everything is looking good in the company, you will see a healthy track record of “top line revenue” and “Cash at hand”. It shows the company has been performing steadily. They have little issues with cashflow and have built up the resources and buffer to face short term pains.

Diagnostic Financial Analytics:

Think of Sales and Marketing stats. If the cash at hand is drying up, chances are it's the marketing department burning it, either through staff costs, or campaigns.

Check sales forecasts, sales pipeline conversion rates and headcounts to find out why revenue is dropping and impacting the top line.

Predictive Financial Analytics:

Look at total cash at hand, cash runway in months as well as monthly burn. Does this trend have a positive slope? Which means the company could be spending more money to grow faster.

Or do you observe a decreasing trend? Meaning the company needs to increase sales, or cut costs, depending on their LTV:CAC ratio.

If the line remains relatively stable, double check that the company is not facing a period of stagnation, and that other indicators of growth are present.

Prescriptive Analytics:

Look at the gross margin and revenue growth rates to get an idea of possible future possibilities and challenges. Another great financial metric, which was mentioned in the previous category is Lifetime Value (LTV) to Customer acquisition Cost (CAC) ratio, which you can read more detail about here. Forecasted LTV:CAC ratios will show you if a company's business plan makes sense in the long term.

Lending and investing in startups is obviously risky, which is one of the main reasons larger financial institutions like banks have been slow to get involved. With greater financial transparency come diminished risks. Understanding exactly how the formulas and functions you use to predict a company's revenue tie into each other, leads to a greater understanding of the interconnectedness of a company's financial performance.

Key Takeaways:

- Knowing which category the analytics you are looking at falls into, helps you understand its role within a bigger picture. We have talked in previous blog posts about leading and lagging indicators. These 5 categories are a further layer of granularity for you to consider.

- Try to develop your own secret sauce of KPI's that fit with your investment or lending thesis to get you the best results. You can mix and match values from different KPI's to try and build indices to give a broader picture. Avoid making decisions on ONE KPI alone. Try to include metrics from each category above.

- If you are dealing with VERY early stage companies, you may need to be more creative in your appraisals. For example, instead of looking at revenue, you might consider total years experience of the founding team. Instead of CAC you might consider the forecasted Cost of Sales etc.