Loan underwriting for SMB loans

Incomplete and inaccurate financial data make the financing ecosystem inefficient.

Calqulate is a financial data platform that provides standardized and reliable financial KPIs in 15 min flat, so that lenders like you can make better business decisions, faster.

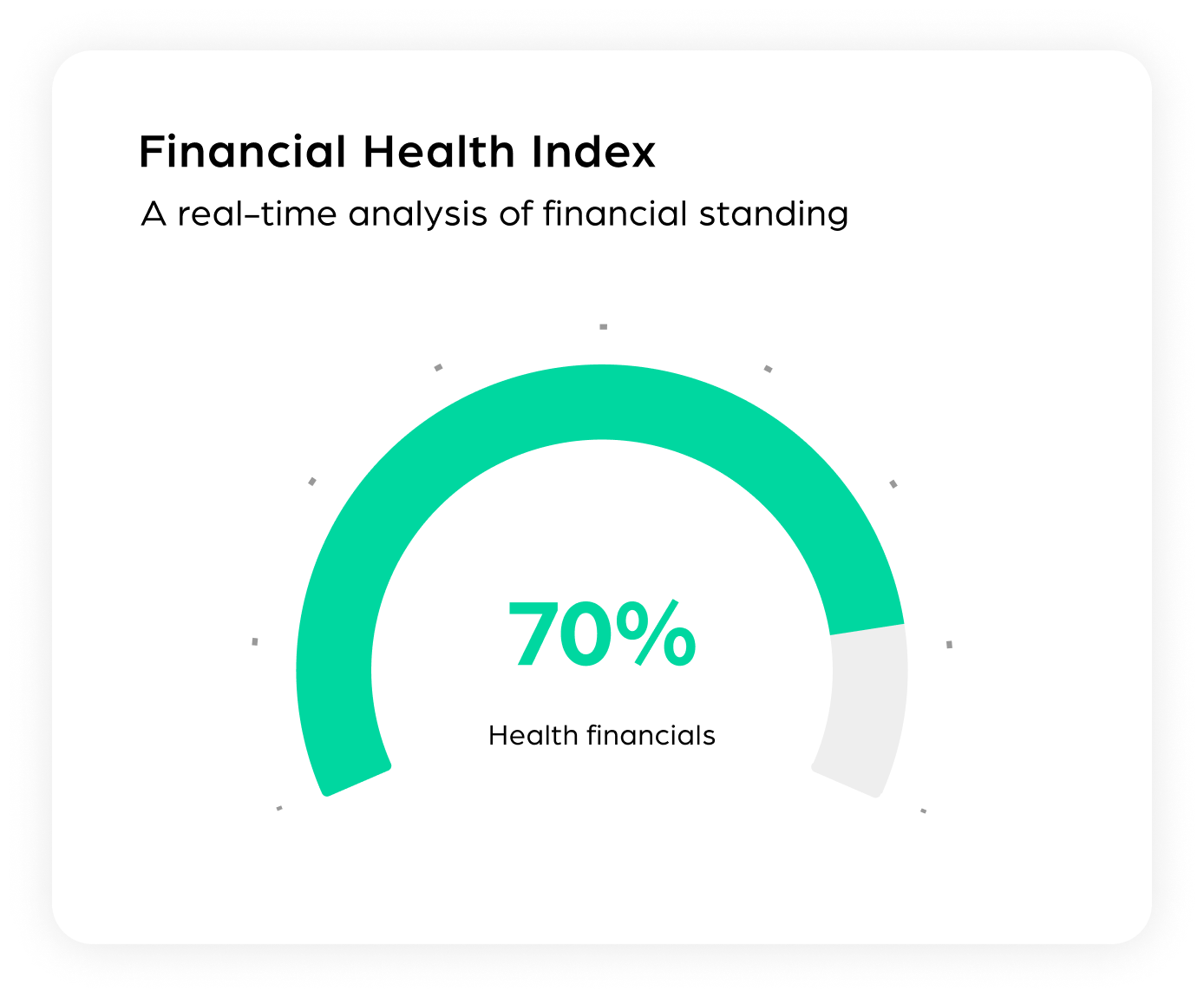

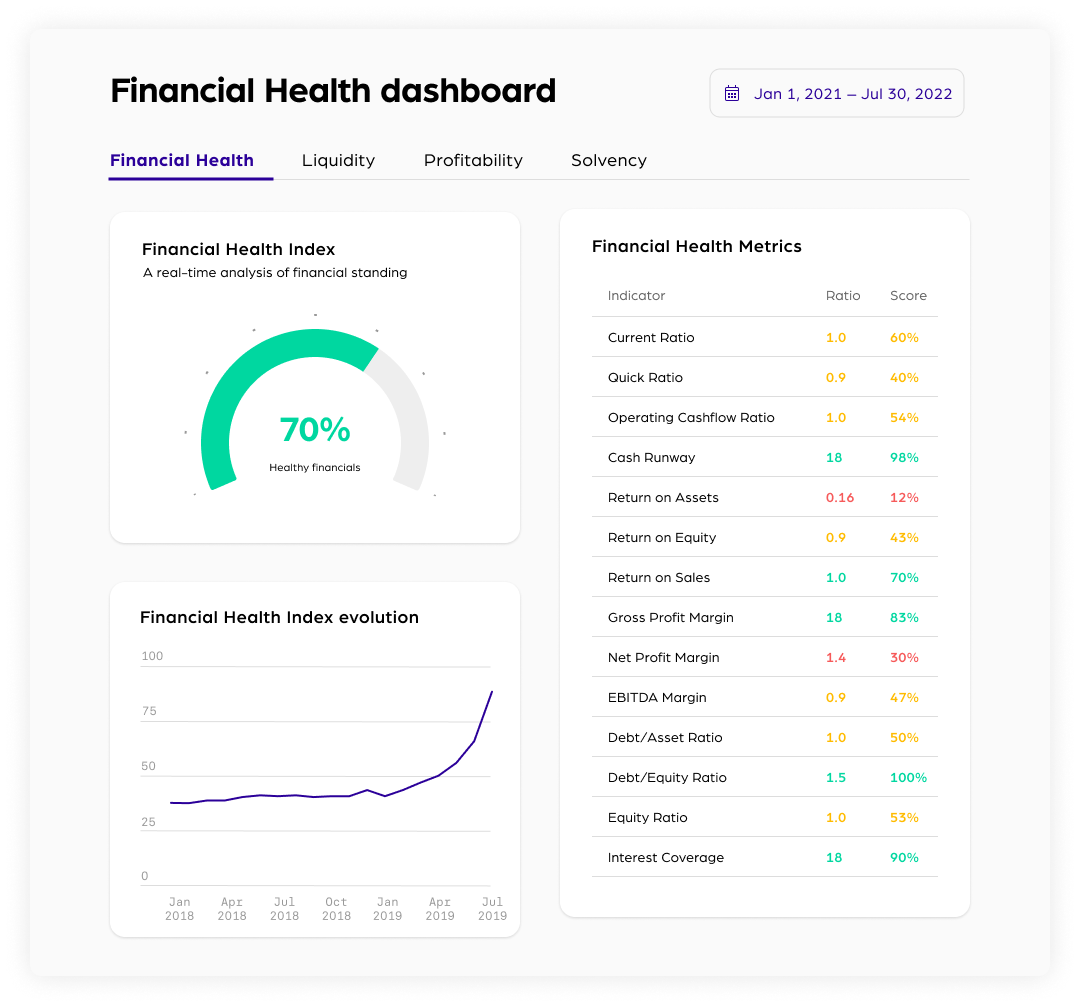

360-degree financial analysis

What used to take weeks now takes minutes.

Forget PDF exports, screenshots, excel files and manual inputs to your financial model. Get instant credit risk analysis of your small and medium-sized enterprise clientele.

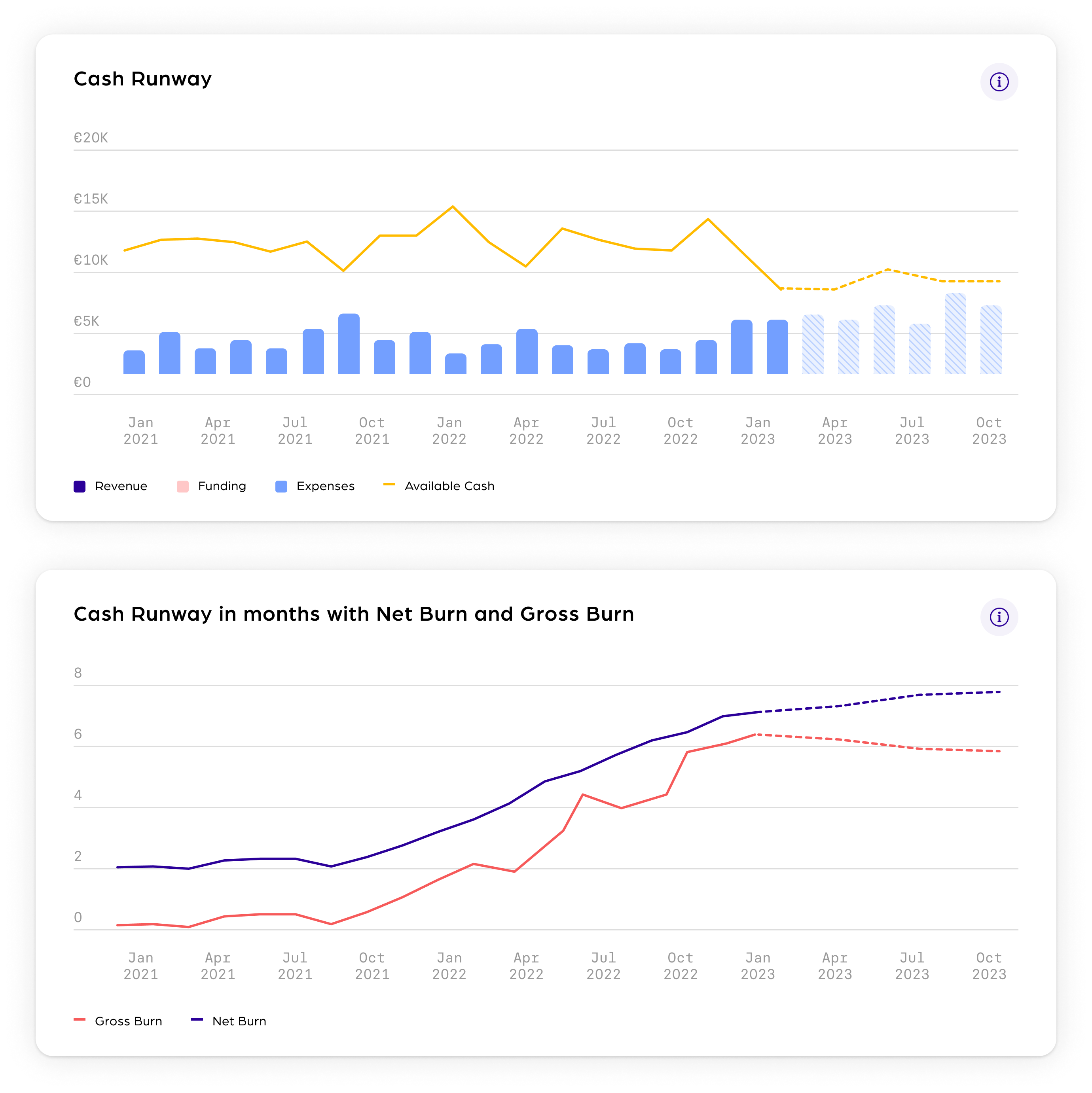

Multi-bank liquidity analysis

Get real-time analytics of cash balances across different banks in the US and Europe, cash runway and cash burn.

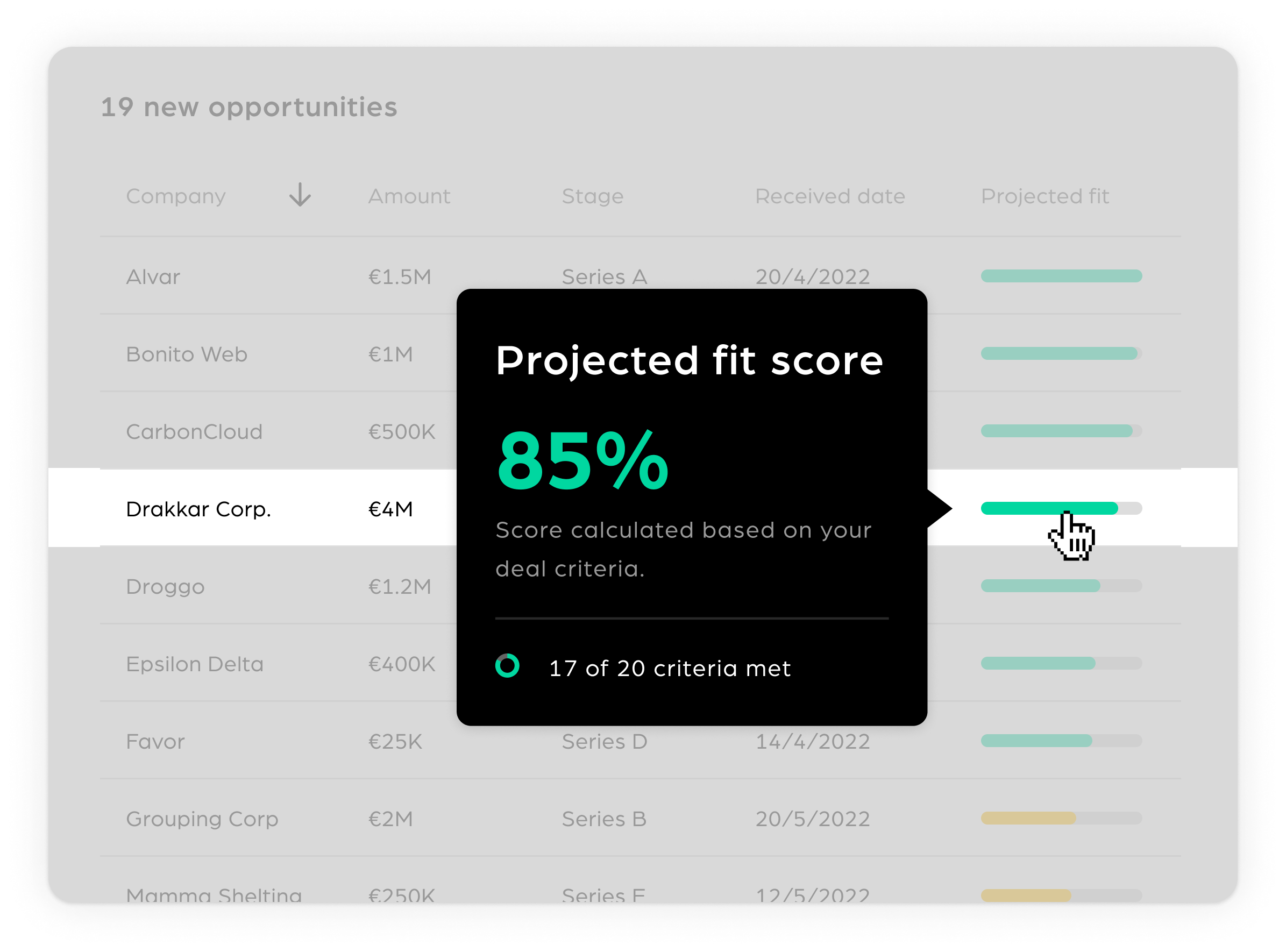

Opportunity score

Calqulate imports financial data directly from the bank, payroll, accounting, subscription, payment and CRM systems. We match this data against your deal criteria so your analyst spot the most promising prospects first.

Use the API or the Calqulate User Interface

Calqulate's powerful API lets you export derived financial KPIs to your own database.

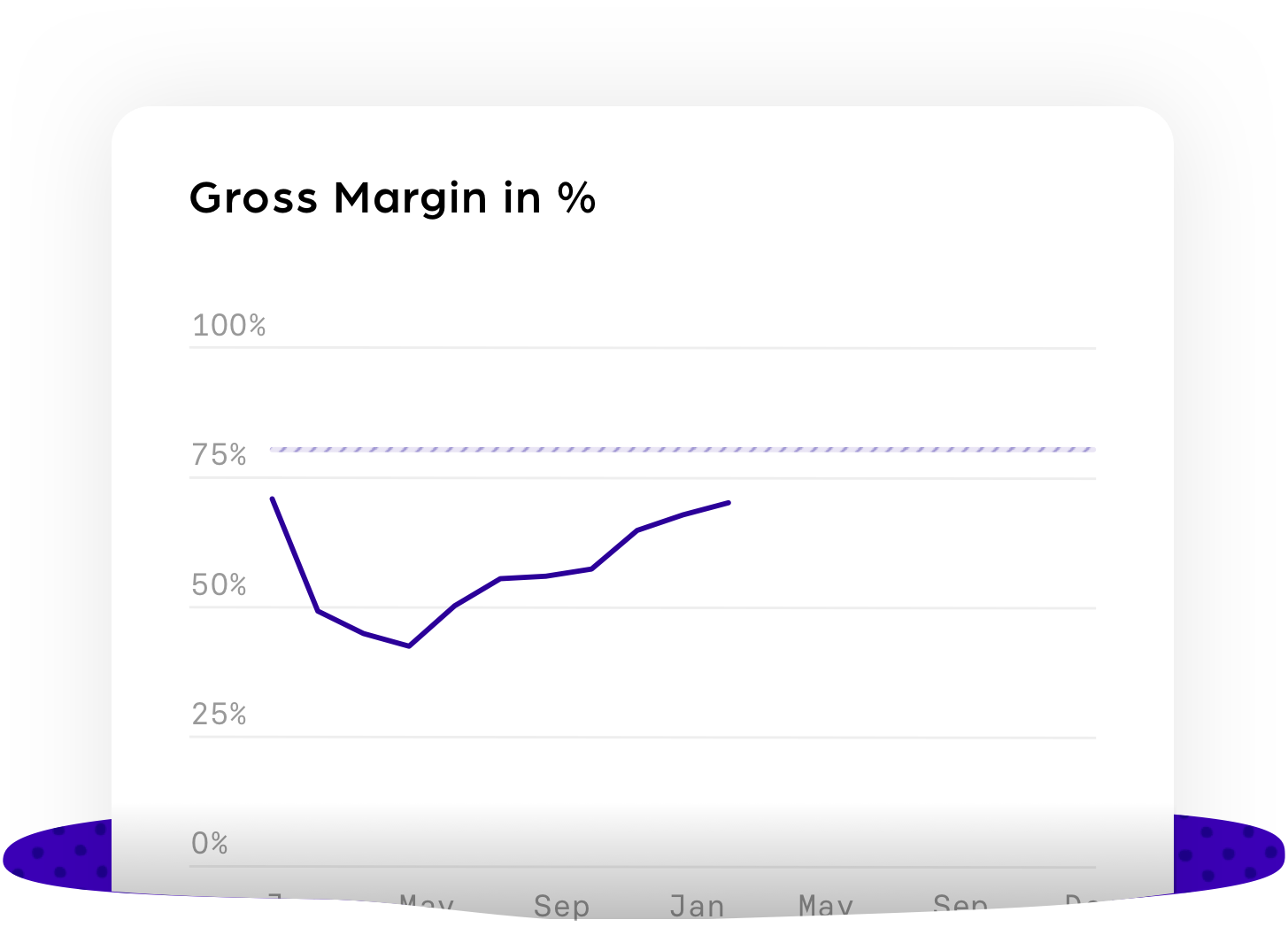

You can also use Calqulate's user interface to view financial data in elegant charts.

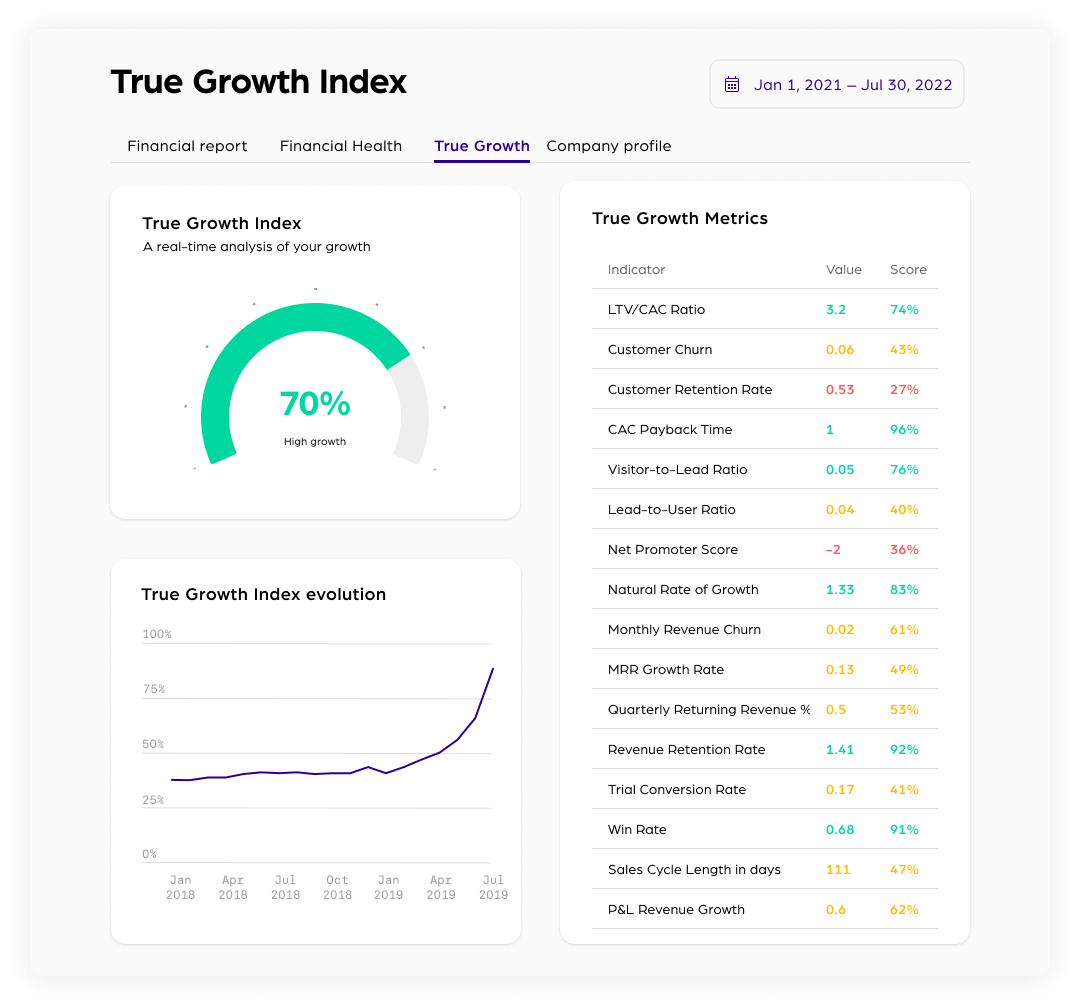

Growth and revenue metrics

Work with startups? In order to get the full picture, you need growth and revenue metrics to complement traditional financial KPIs.

Calqulate's 360-degree financial analysis includes growth metrics, unit economics, retention and revenue metrics.

Become a Startup Finance Expert

Want to learn more about Startup Finances? Head over to the Calqulate Academy and become a startup finance expert.

While recurring revenue is important, a company’s growth rate is even more valuable to the overall valuation of the business.

Companies with a higher growth percentage are more valuable than companies with a lower growth percentage. The valuation difference can be 15-fold.