If you’ve ever been on a scavenger hunt, you’ll know that you’ll need the following elements to win:

- The right team;

- The ability to solve challenges quick;

- The ability to pick up on clues;

- Proper resource allocation;

- And more.

The list is endless. But at the heart of it, it’s all about strategy. It’s no different than running a SaaS business.

Pricing

This is pretty straightforward: What is your average selling price? Your pricing places a ceiling on your Customer Acquisition Costs (CAC). It also has a direct relationship with risk. The higher the price, the higher the risk for your customers. And they would desire a more personal connection with your business. It means having a solid customer success team which translates into more cost for you.

Complexity

There are two aspects to this: your product and the sales process. How difficult is it for your customer to make a purchase? Is your SaaS offering easy to find, understand, try, buy, and use?

Any kind of friction that stands between your product and your customer reduces your sales and increases your costs. The more complex the purchase, the more help they will need, which will reflect in your CAC and Total Cost of Service (TCS).

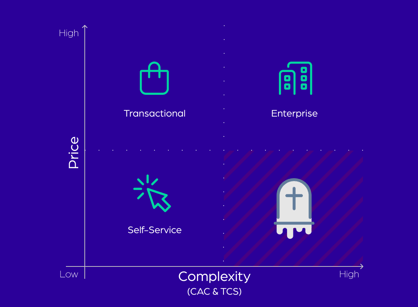

Here are the three SaaS sales models:

- Self-service: a low-priced product with fully automated customer acquisition, onboarding, and payment. The annual contract value of one subscription is usually less than $2,000.

- Enterprise: a high-priced product that requires a sales team with long sales cycles and account-dedicated customer success management. The annual contract value of one subscription is at least $10,000.

- Transactional: a hybrid model with a higher price point compared to the self-service one. Works well in combination with an efficient automated lead generation strategy and a small sales team to convert them into paying customers. The annual contract value of one subscription is at least $5,000.

Note: Annual contract value (ACV) is a vanity metric when it is examined as a standalone metric. Always look at it as part of other metrics such as the number of qualified leads, close ratio, sales cycle, and other crucial sales metrics.

Let’s say you have enterprise-grade project management software. Your product is likely to include a security guarantee and has different service level agreements (SLAs) for your customers. You’ll probably have to run a few demo sessions before closing a sale, and you need an account-dedicated (and costly) customer success team – it means that each customer has a dedicated contact person to reach out to when they need support. All of these translate into costs and will reflect in your pricing.

In comparison, if you have a music streaming app like Spotify, your customers only need to sign up for a subscription to start using the product without needing additional onboarding support. Your customer success team is there to help only when needed – for example, a login error or a payment error.

Most SaaS companies are in the self-service and transactional space. The goal is to move from one quadrant to another as your business expands. It could be from:

- Self-service to enterprise

- Self-service to transactional

- Transactional to enterprise

- Transactional to self-service

It’s normal for businesses to evolve as they see fit. Needless to say, the only quadrant you should avoid is the SaaS graveyard. Sadly, many SaaS companies still end up there.

Let your metrics speak for you

The first step to make sure you don’t step into the graveyard quadrant is to make sure you have enough cash. It’s like going on a long hike on mountainous terrain. You need to make sure you have enough food and water as well as other necessities with you.

The only way to not run out of cash is to watch your metrics like a hawk and allocate your resources wisely. To avoid the SaaS graveyard, you need to:

- Increase sales volume – keep your price point low and drive out complexity to build volume. This strategy works best for the self-service SaaS sales model. Once you start having a steady stream of Monthly Recurring Revenue (MRR), you will also be able to start lowering your CAC.

- Increase profit – This is a tricky one for many startups. How do you find the sweet spot between generating revenue and lowering your CAC? The answer lies in your CAC payback time.

The average payback time is approximately 9-12 months, depending on your subscription model. But some companies take a longer time to break even. That means they also take a longer time to generate profit.

The rule of thumb is to always aim for a CAC payback time of fewer than 12 months in any scenario to increase your revenue growth. The best way to do that is to motivate your customers to sign up for annual deals. By doing that, you not only quadruple your MRR, you’ll also lower your CAC significantly. - Increase value – This is to increase your MRR by adding value through product innovation and restricting your market to target customers who see the most value in your product. To do this, you can rely on your Average Revenue Per Account (ARPA) and Customer Lifetime Value (LTV) to identify your best customer segment.

Once you’ve identified them, you need to figure out how to attract more of these customers. The great thing about customer segmentation analysis is that you no longer need to cast a wide net and hope to entice a few of those. That also means lower CAC.

Increasing value to your customers is a great way to expand your Net Revenue Retention (NRR) and scale towards the enterprise quadrant.

It’s crucial to rely on your financial analytics when making strategic business decisions. That’s a sure-fire way to avoid the SaaS graveyard.

Once you’re able to understand your metrics better, you’ll be able to understand which part of your business is underperforming and identify opportunities for improvement.

Go deeper: Metrics – a list of what you should have

Now let’s take a look at some examples:

Self-serve

Let’s say you’re a self-service SaaS business. It means you won’t need a sales team. Your focus is to ensure your product is frictionless and top-notch. We’ll assume that:

- You’re aiming to make $500,000 in Annual Recurring Revenue (ARR) at $50 per account.

- That means your ACV for each customer is ($50 x 12 =) $600.

- You’ll need to acquire around 830 new clients to hit your ARR target.

- Your conversion rate is 10%, you’ll need to attract around 8300 new potential customers.

- You’re aiming for a gross margin of 80%. That means you’d be left with a gross margin of ($50 x 0.8 =) $40 per customer.

- Your customer lifetime is 24 months. Therefore, your LTV is ($40 x 24 =) $960 per customer.

- A healthy LTV to CAC ratio is 3:1. To achieve this, your CAC ceiling is ($960/3 =) $320 per customer.

- In this case, your CAC payback time is ($320/[50 x 80%] =) 8 months.

This is still a relatively healthy business. Your metrics are still looking great.

Now, we’ll assume that your customers have been facing a lot of friction – while using the product and/or purchasing it. As a result, your churn rate increases from 4.1% to 10%, and your CAC increases from $120 to $400 for each new customer.

A profitable SaaS business model should have a gross margin rate of 80-90%. If the value of a customer is 3 times its acquisition, it means that each acquired customer should be generating a revenue of $1500 per year for you to achieve a gross margin of 80%.

Your metrics do not look great with an ACV of $600 and a CAC of $400. This means you’re heading for trouble fast. If you don’t make the necessary adjustments, you’ll be heading towards the SaaS graveyard.

Enterprise

If you’re a SaaS business in the enterprise sector, it means you need an entire salesforce to close sales and onboard customers. That translates into cost. We’ll assume that:

- You’re aiming to make $2,000,000 in ARR at $40,000 per account.

- Your ACV for each customer is ($40,000 x 12 =) $480,000.

- You’ll need to acquire around 5 new customers to hit your ARR target.

- Your conversion rate is 10%, you’ll need to attract around 50 new potential customers.

- You’re aiming for a gross margin of 60%. That means you’d be left with a gross margin of ($40,000 x 0.6 =) $24,000 per customer.

- Your customer lifetime is 60 months. Therefore, your LTV is ($40,000 x 60 =) $2,400,000 per customer.

- A healthy LTV to CAC ratio is 3:1. In order to achieve this, your CAC ceiling is ($2,400,000/3 =) $800,000 per customer.

- In this case, your CAC payback time is ($800,000/[$40,000 x 60%] =) 33 months.

This is a relatively healthy business with some caveats. Relying on a small number of customers means that you must keep all of them delighted so that they don’t churn. A churned customer means a 20% churn.

Also, the CAC per new customer and the CAC payback time are relatively high. It means high upfront CAC-related cashflows. After the CAC has been paid back, this would translate into a profitable business.

Conclusion:

Having the knowledge and understanding of your metrics is powerful. That said, we always start with the numbers. Why?

Because it wouldn’t matter which quadrant of the SaaS sales model you’re in, you’ll be able to build a growth engine to help you navigate towards scaling. But more importantly, to help you avoid the SaaS graveyard. If you're still looking to serve all customer segments after reading this article, you can still consider personalizing your website to capture enterprise customers without sacrificing self-serve.

The teams who usually win a scavenger hunt are the ones with a certain level of knowledge about the area they’re in or what they’re dealing with. So yes...the more you know, the better.

By the way, scavenger hunts are excellent team-building exercises to try out. Happy Calqulating!