Matchmaking between Investors and Startups

Calqulate provides high-quality matchmaking and helps expand the deal flow for investors in your network. We connect and standardise real-time financial data and remove manual work from opportunity analysis and matchmaking processes. Perfect for Business Angel Networks (BANs) and professional fundraising advisors.

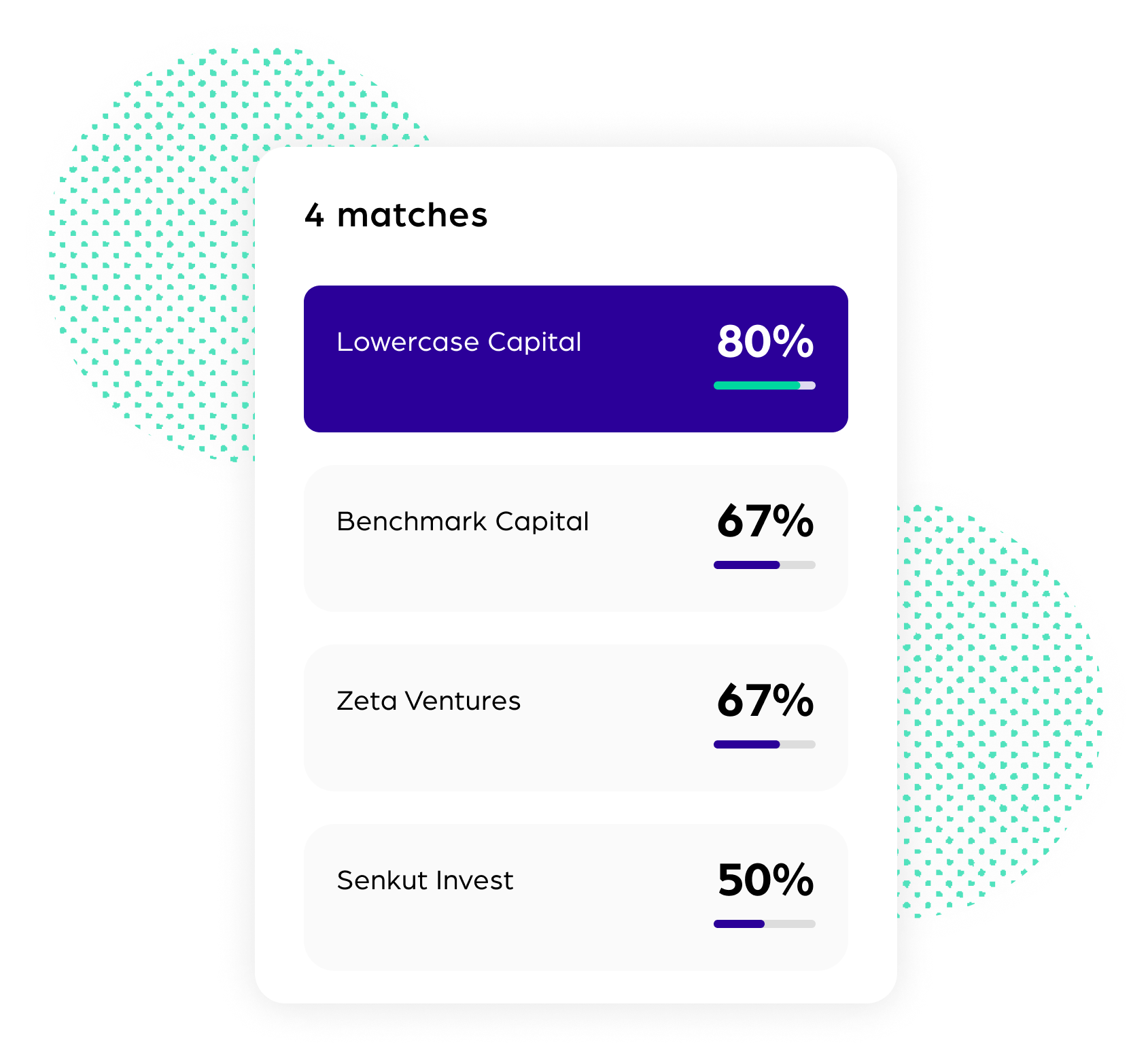

Automated matchmaking and syndicates

Direct your startup deal flow to Calqulate and connect them with investors in your network. Calqulate’s Projected Fit Score compares an investor’s deal criteria against a company’s financial KPIs and finds the best matches.

You can share co-investment opportunities with multiple different investors and close deals faster.

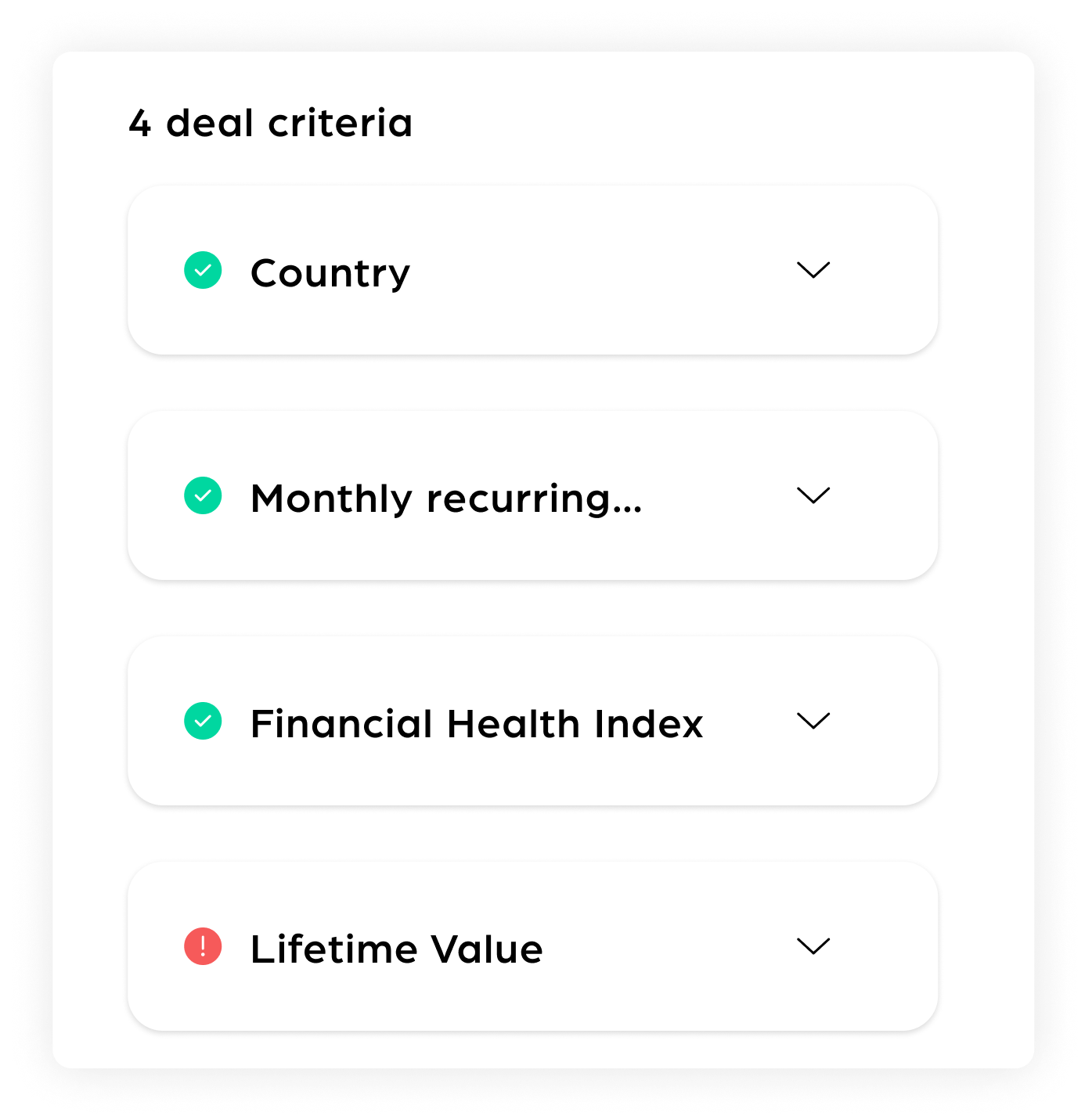

Deal Criteria

A deal criteria can be anything from the target company’s financial performance to geographical preferences and ticket sizes. Get access to a large international database of investors' deal criteria in Calqulate or easily set specific deal criteria for yourself and your network.

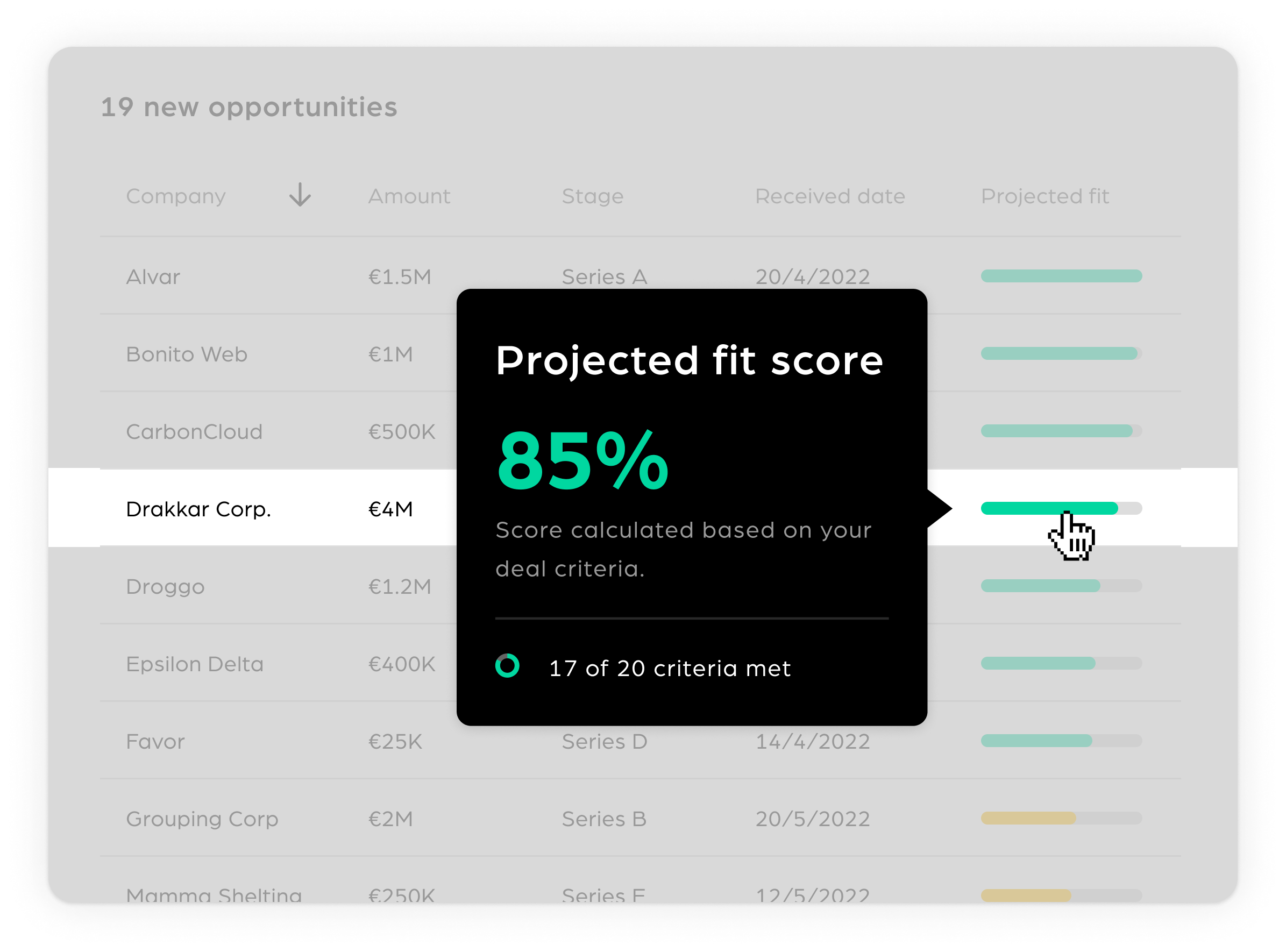

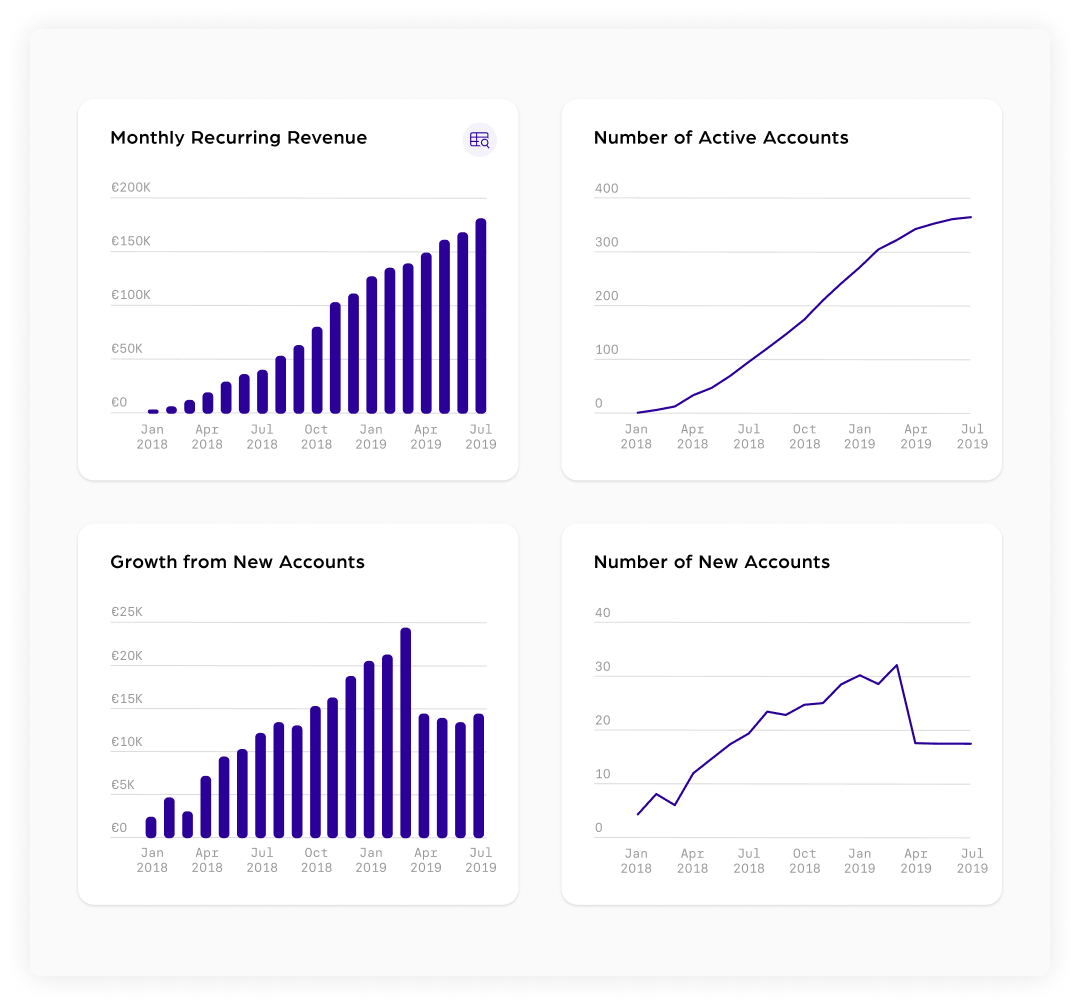

Projected Fit Score for all investors

Calqulate’s Projected Fit Score compares a company’s financial KPIs against the deal criteria of each investor in your network and helps you spot the best matches.

Traction Analysis in 15 minutes

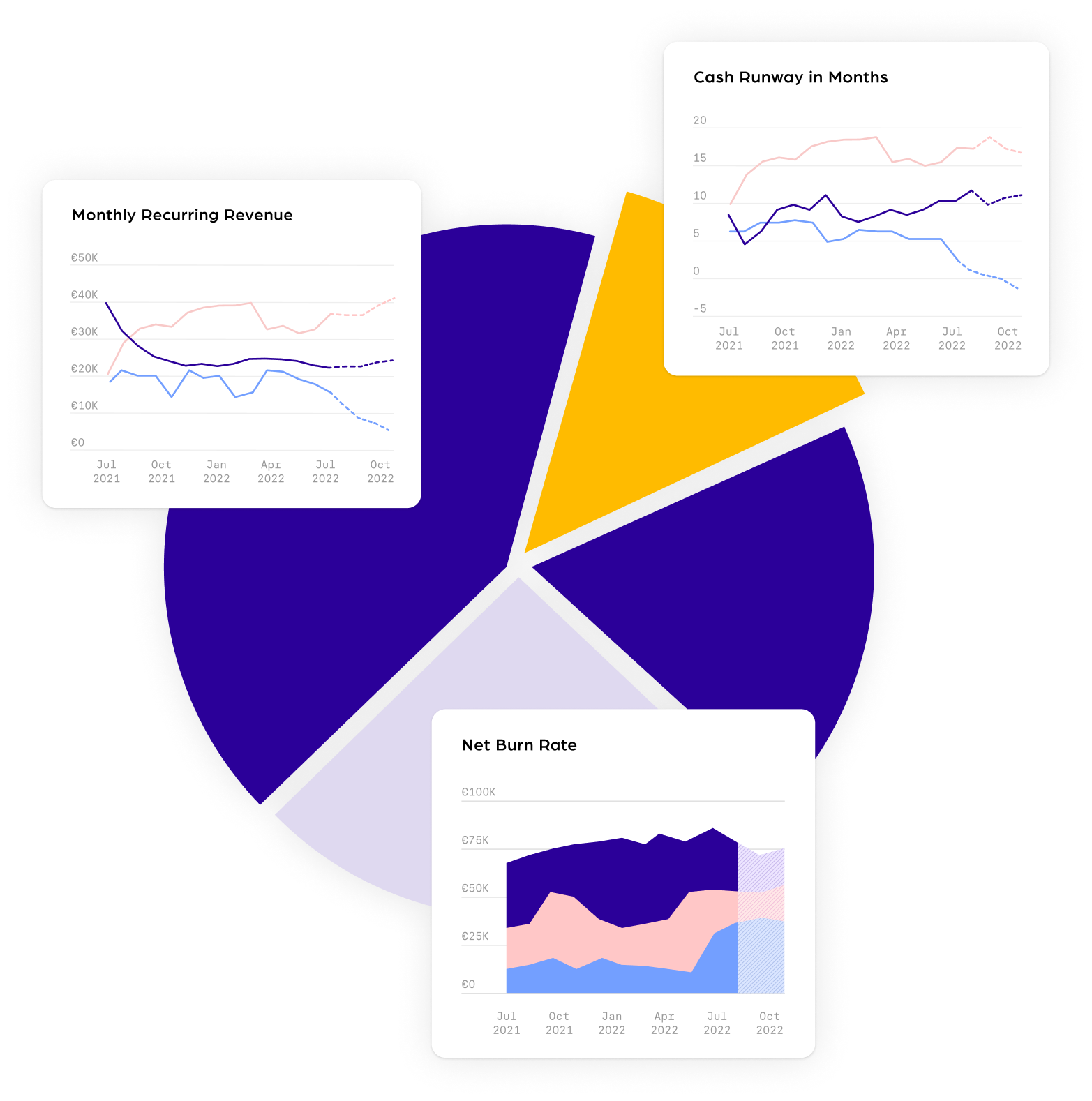

The investors in your network can use Calqulate’s Assess to perform traction analysis in 15 minutes. Real-time financial KPIs on cash runway, revenue, profitability and key industry metrics such as MRR, LTV and CAC.

Portfolio monitoring

The investors in your network access a real-time view of their portfolio companies' financial performance with Calqulate’s Monitor. No more late reporting in multiple PDFs, excel files or emails. Get standardized, real-time financial data for all portfolio companies.

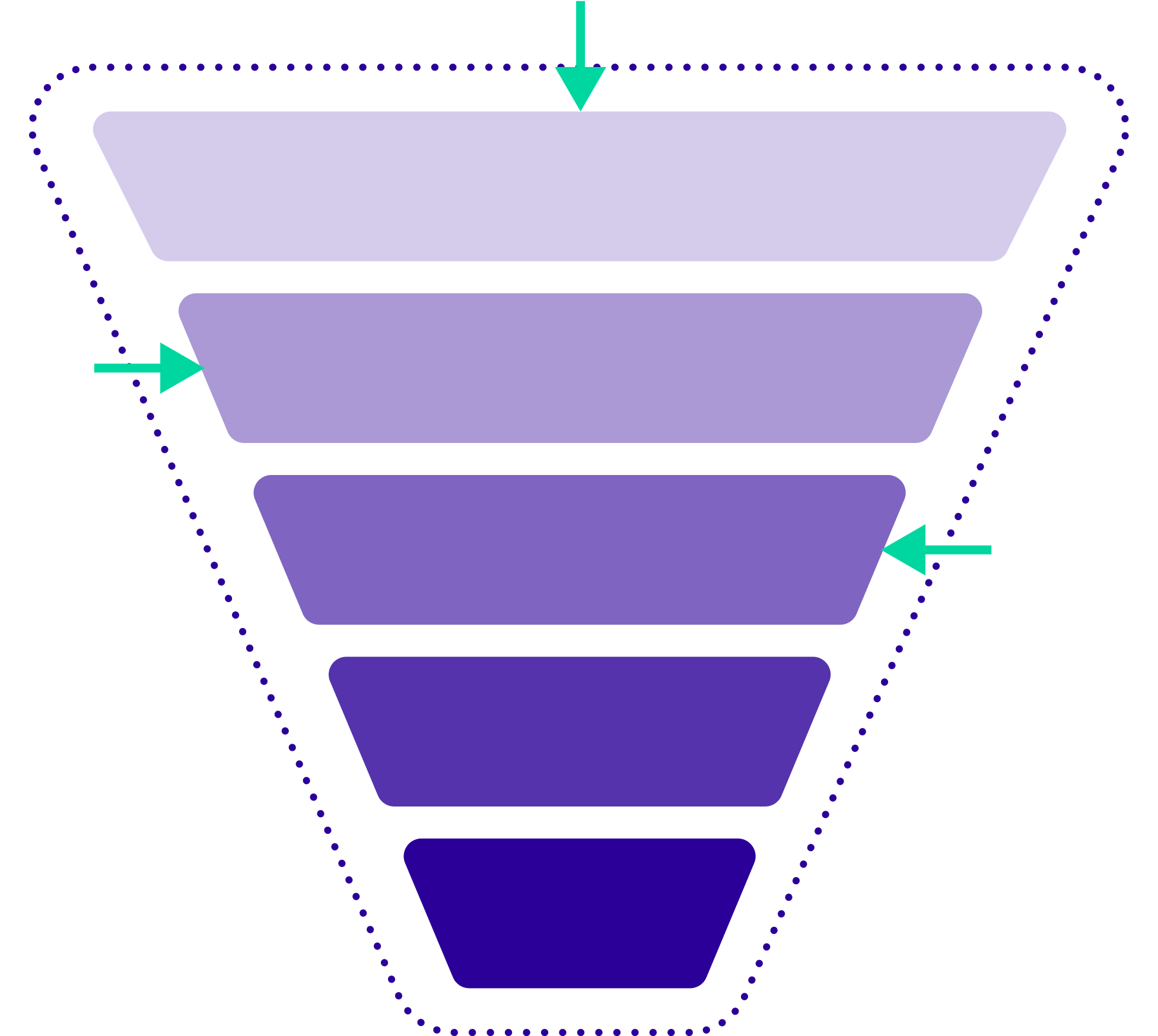

Multiple pipeline entry points

Inbound opportunities or outbound prospecting? Connect your deal flow to Calqulate, or match companies that are further down the pipeline. You choose the most suitable entry point, we help you make matchmake.

Standardized financial data

No more waiting for ad hoc reporting from startups. Calqulate connects directly with a startup's bank accounts, accounting software and other financial data sources. With that live data, we provide standardized, reliable and unaltered financial KPIs and calculate a Projected Fit Score for each match.