Loan Underwriting and Deal Screening

Incomplete and inaccurate financial data makes the financing ecosystem inefficient. Calqulate provides standardized and reliable financial KPIs in 15 min flat.

Integrate directly with the accounting and banking services of your borrowers so you can guarantee the most up-to-date due diligence. We seamlessly improve your underwriting and empower you to make better business decisions faster.

Deal Screening for Lenders

Calqulate is a loan deal origination and deal screening platform that accelerates lender's deal flow and automates manual processes.

Perfect for:

- Venture lending

- Small business loans

- Corporate financing

- Revenue-based financing and more

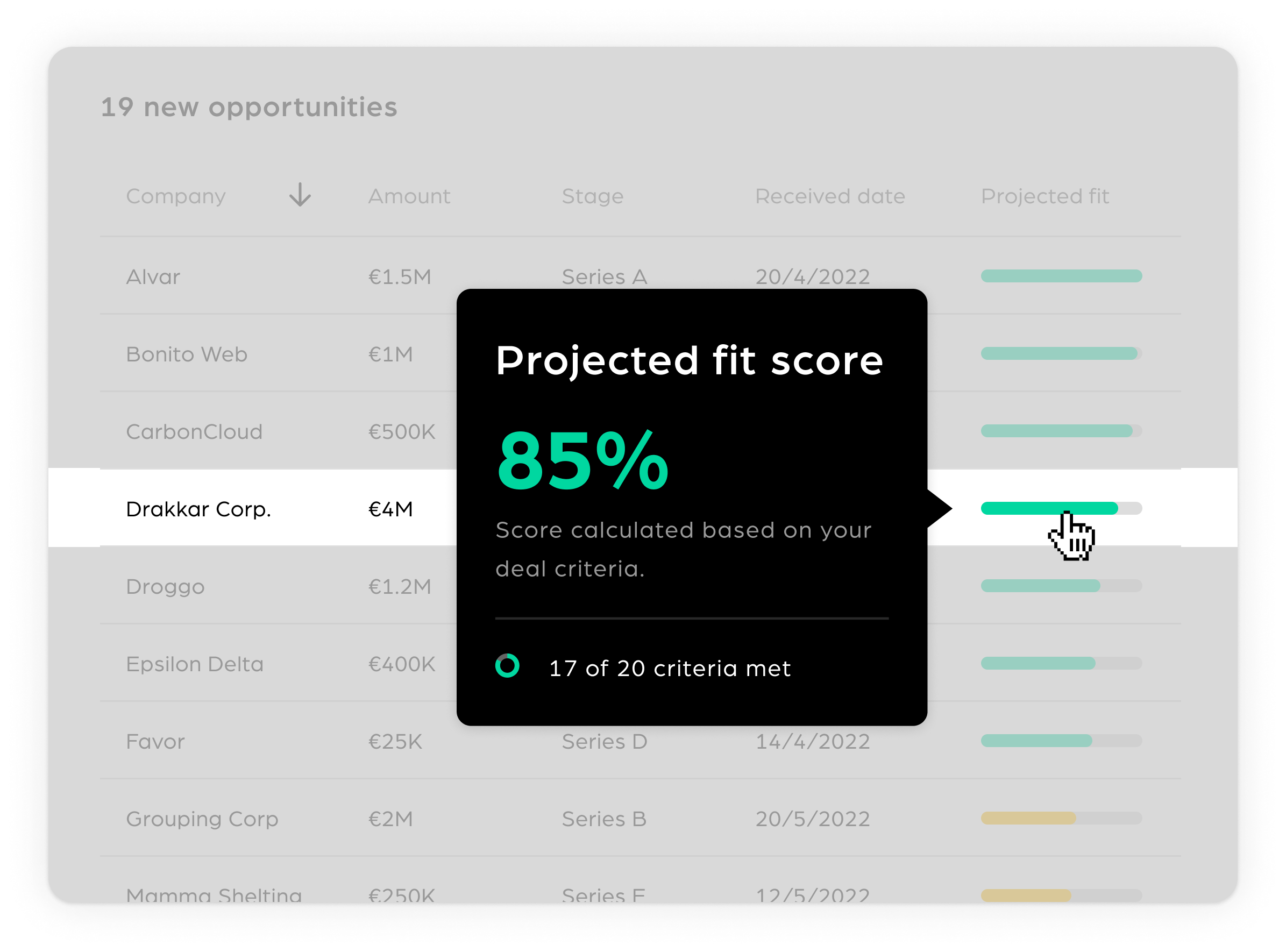

Opportunity Score

Calqulate imports financial data directly from the bank, payroll, accounting, subscription, payment and CRM systems. We match this data against your deal criteria so your analyst spots the most promising prospects first.

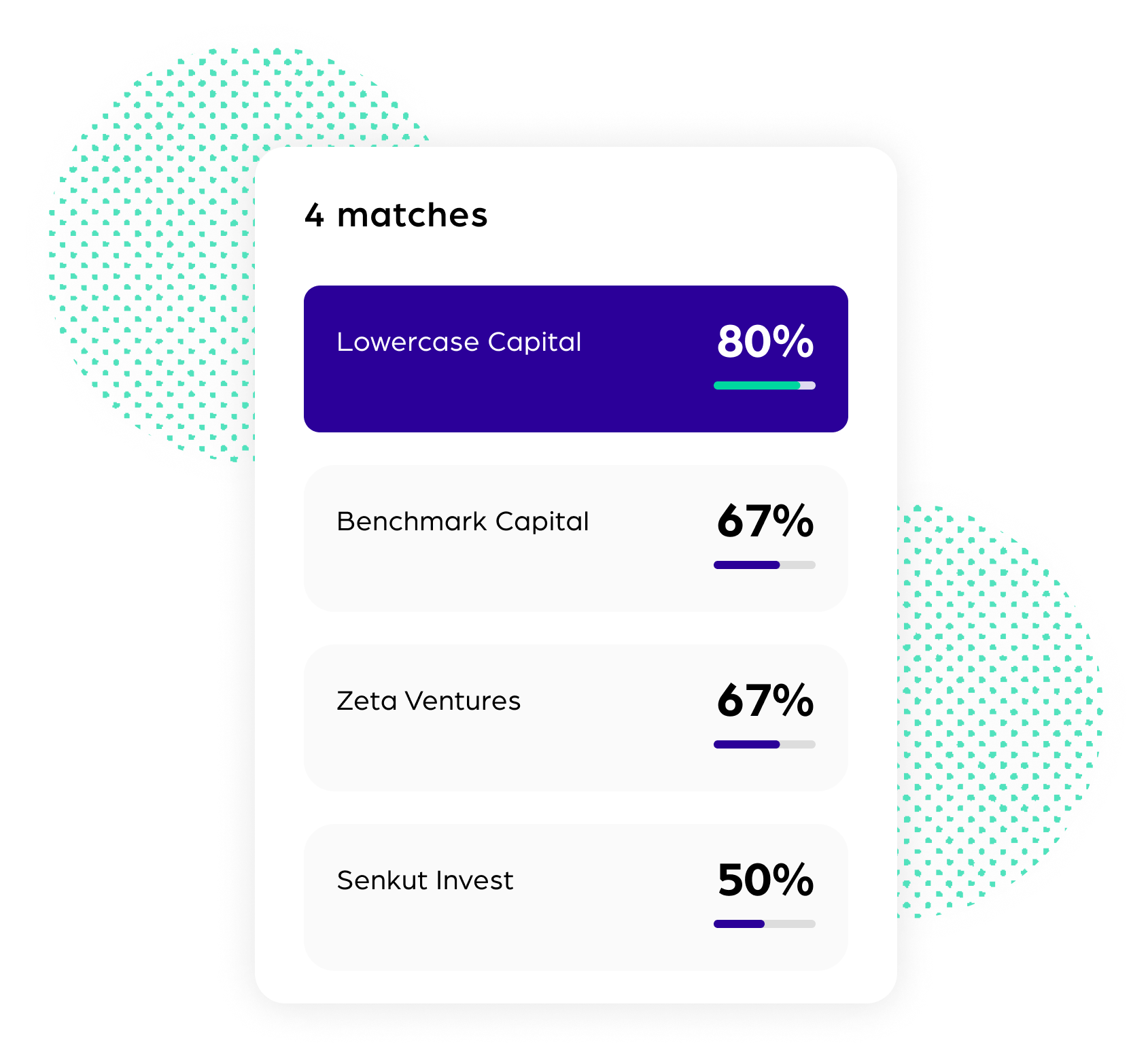

Automated matchmaking with multiple lenders

Add the lenders in your network and their deal criteria in Calqulate and get automated matchmaking between the opportunity company and all the lenders. We connect the dots between players and help you move deals to "closed" quicker.

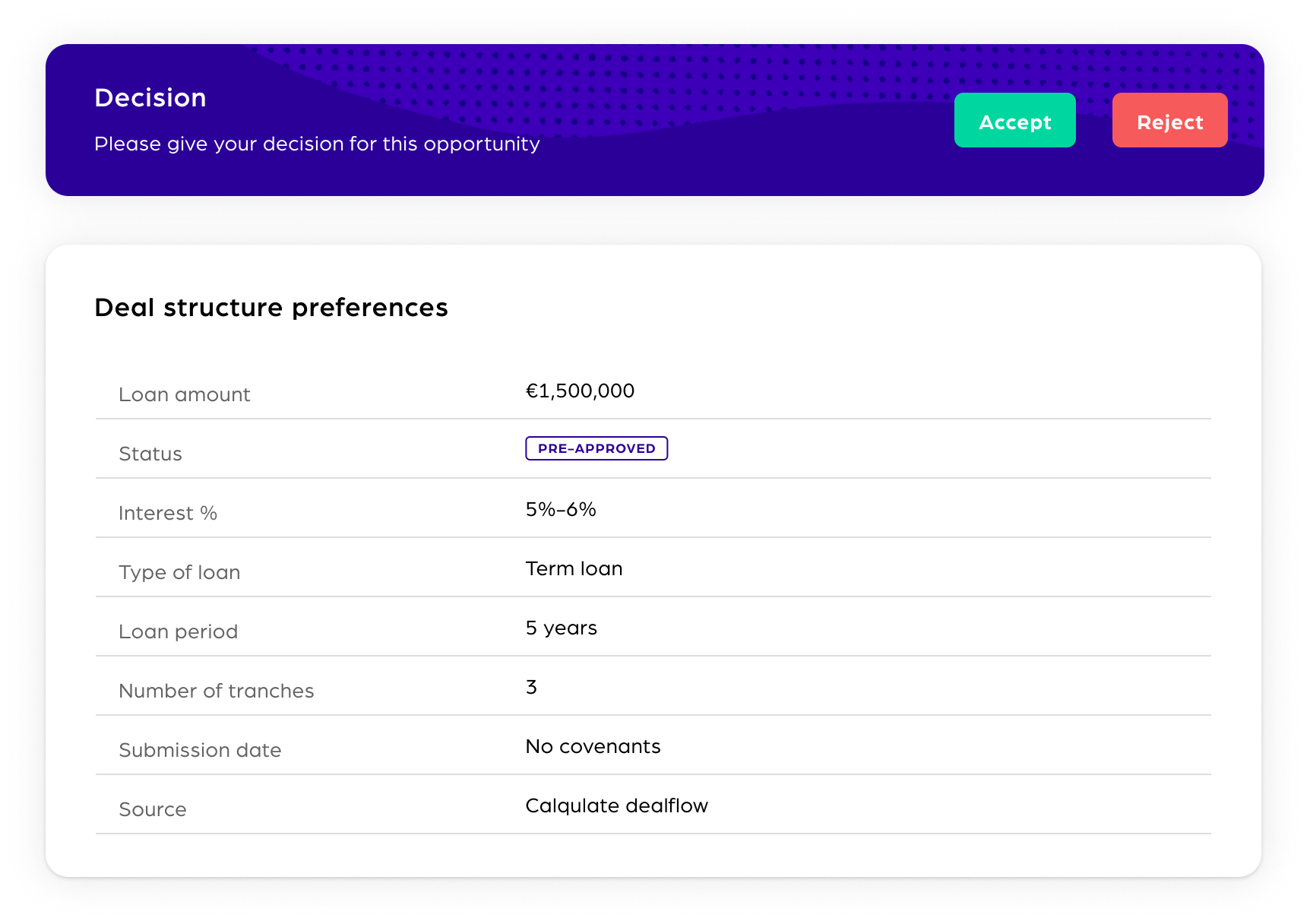

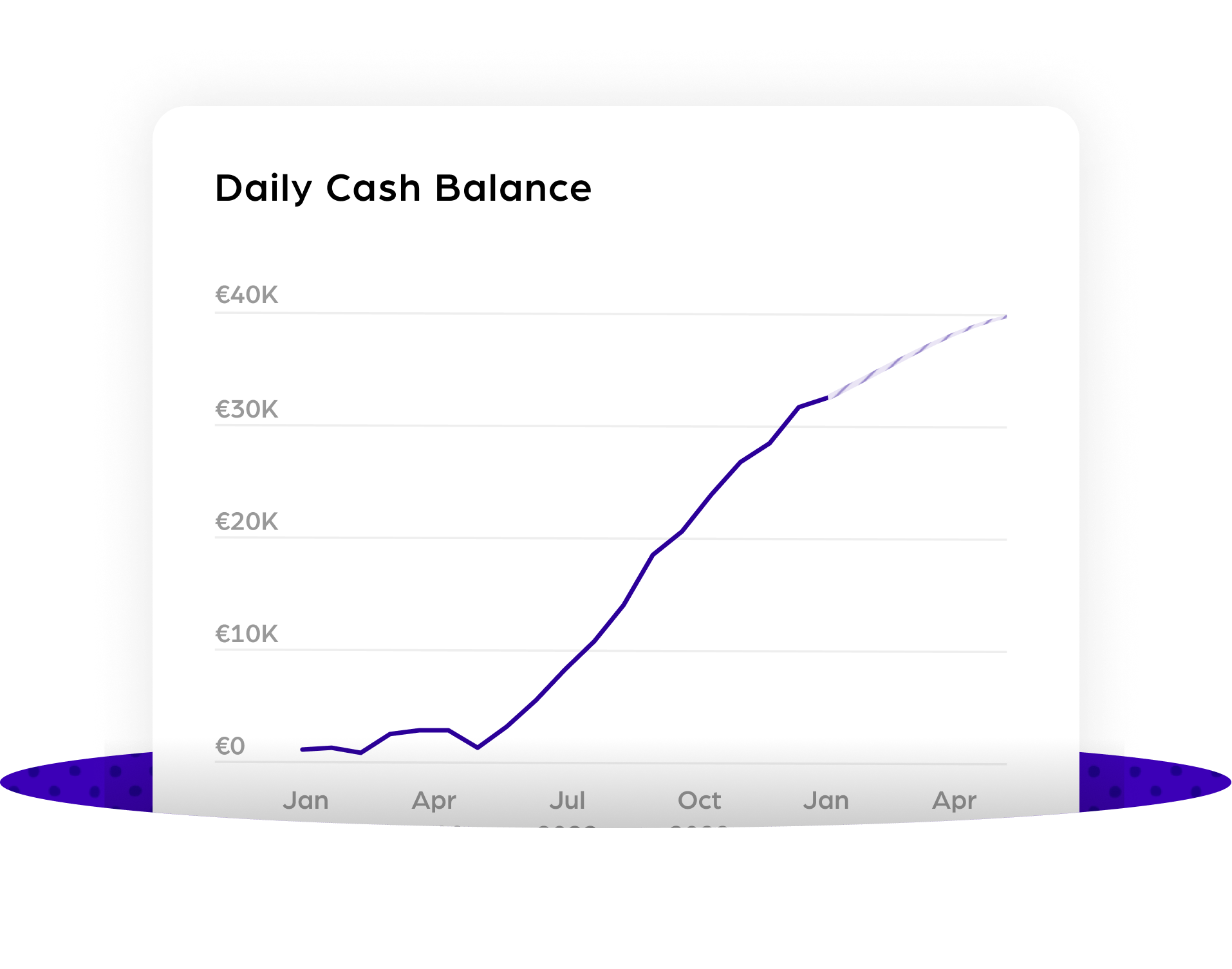

Covenant tracking and real-time financial reviews

No more waiting for ad hoc or sporadic reporting from borrowers. Calqulate syncs financial data hourly across the finance stack. Financial analytics are always available in real time for lenders like you.

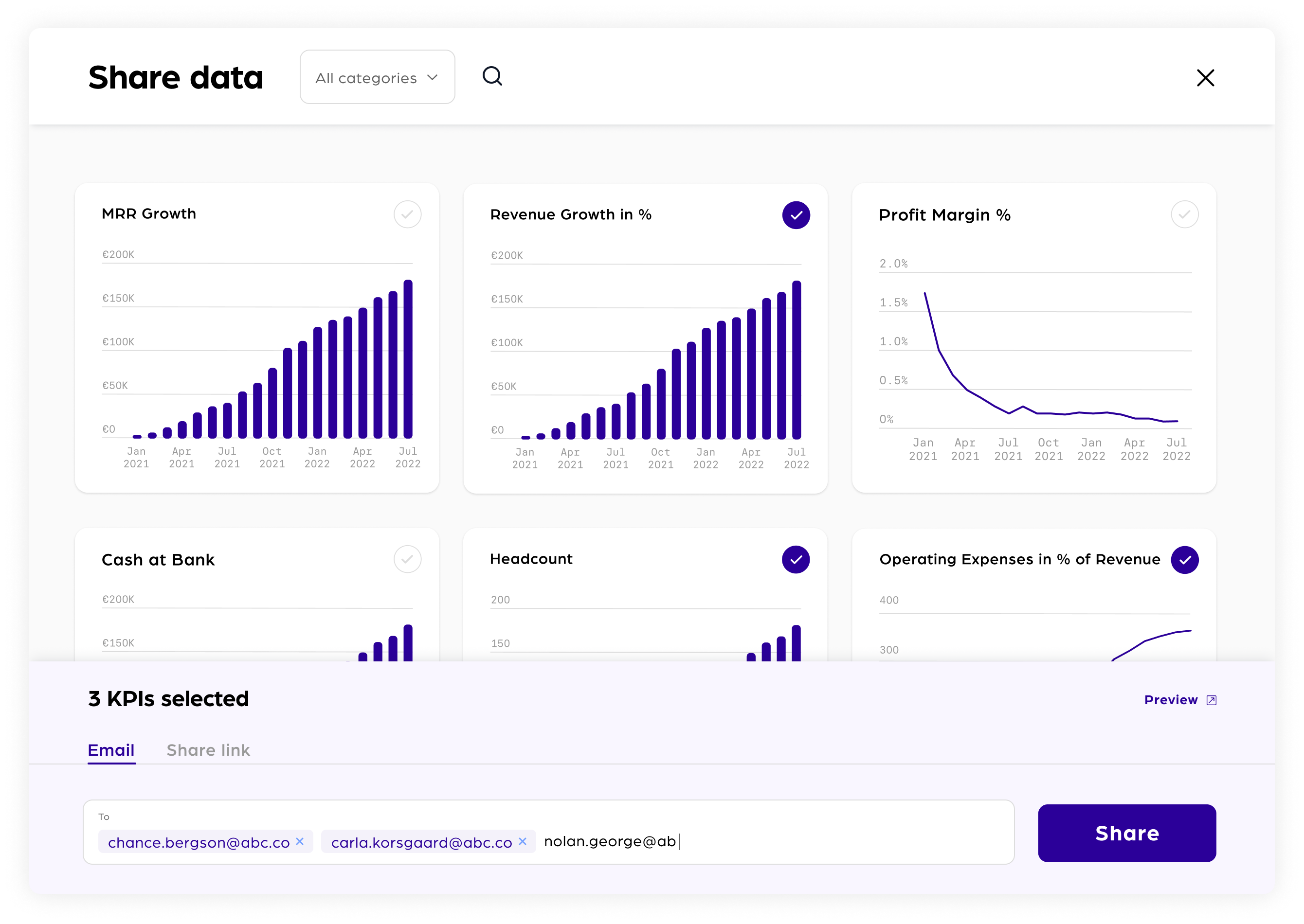

Request Data from Companies

Integrate Calqulate into your onboarding process to speed up the collection of data from small and medium-sized businesses. You can send a request to a company in our ecosystem to view their financial data. Once they accept, we open a connection and you gain access.

.png?width=1914&height=1527&name=Financial%20Health%20(FHI).png)

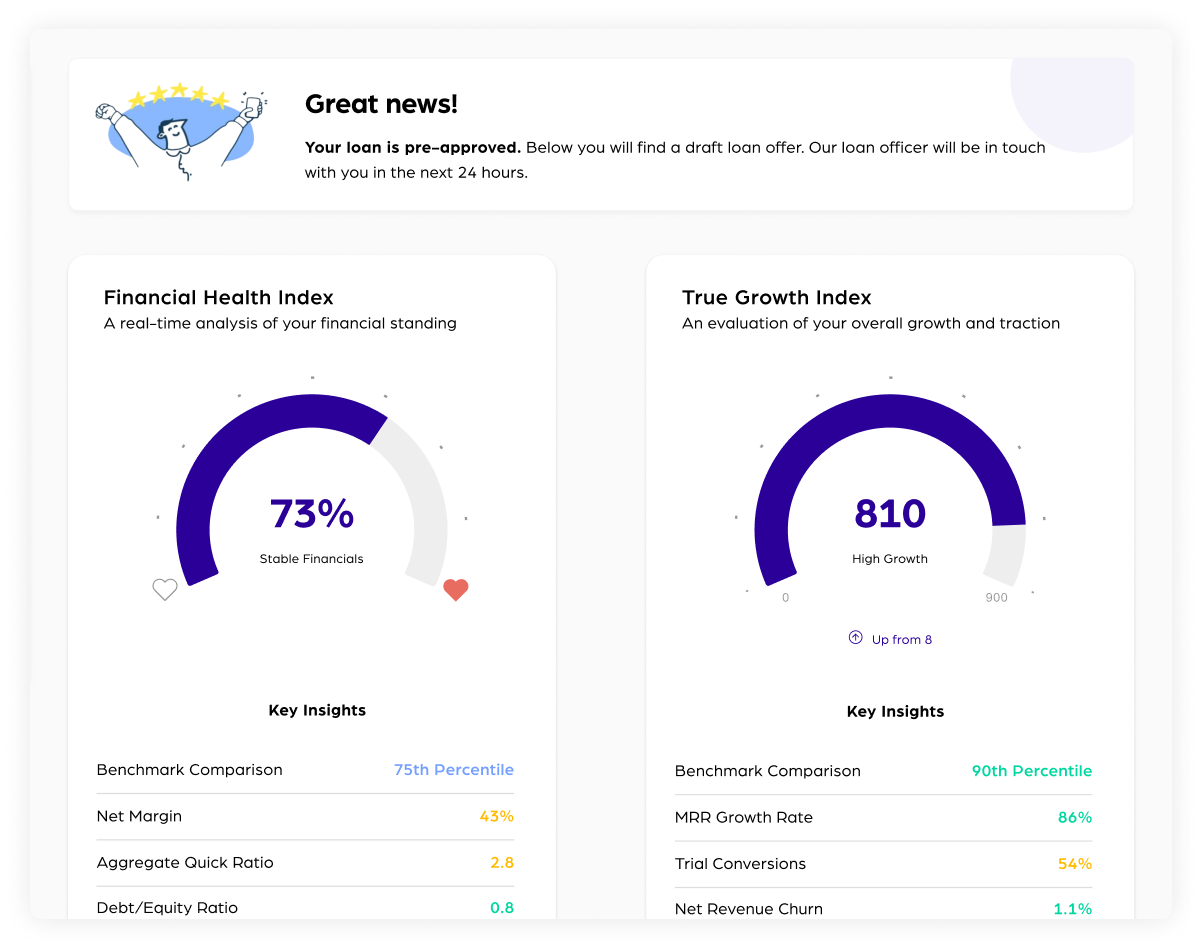

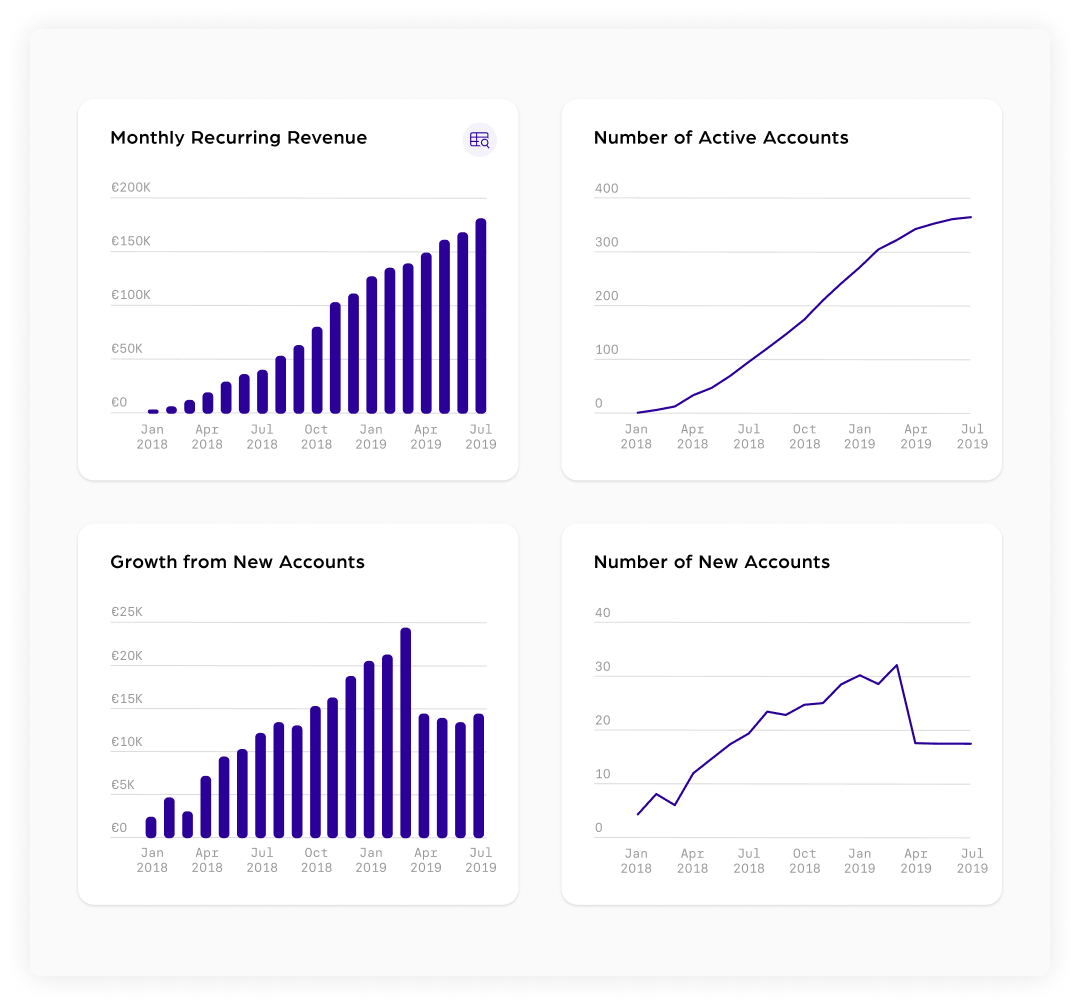

Instant Financial Due Diligence and Financial Health Scores

Calqulate helps lenders to access unified financial data for their current and prospective clients, fast-tracking credit risk analysis and financial due diligence processes.

Create your own Financial Health Index and True Growth Index from Calqulate’s financial KPI catalogue.

Standardized financial data for all small and medium-sized companies

Each CEO has their own secret sauce for their Financial reporting. Calqulate standardizes and refines financial KPIs for small and medium-sized businesses across multiple countries and verticals. We smooth the data by standardising it, so you don't have to chew through incomplete and unstructured data when making your decisions.