Easy business loan comparison

Business loans help companies build, maintain and expand their growth. Calqulate makes loan comparisons easier and helps find the best funding option among a global network of lenders.

Apply for funding

Find the most suitable lender and submit your loan application in minutes, all within Calqulate.

Wide range of financing opportunities

Whether it’s a small loan for a short-term need or a bigger one for expanding to a new market, Calqulate’s large network of lenders help get the best loan offer in no time.

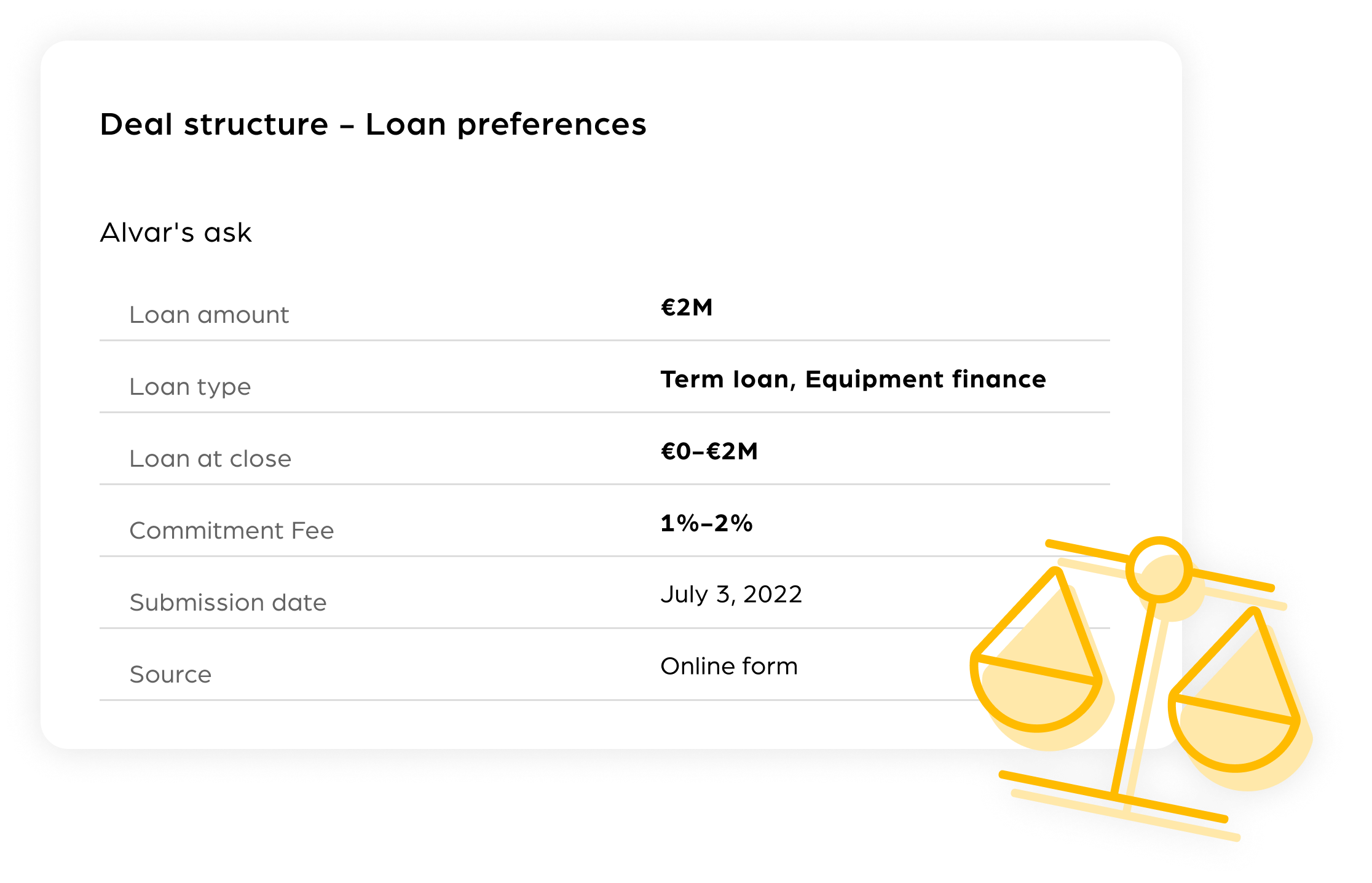

It takes only a few minutes to fill an application and set up a business loan in Calqulate. Once submitted, the loan request is automatically compared against the deal criteria of different lenders in our global network.

Loans for startups and SMBs

Are you a startup looking for revenue based financing or venture debt? Or a mature SMB looking for bridge loan or a term loan? We got all types of startups and SMBs covered with different types of lenders and loans.

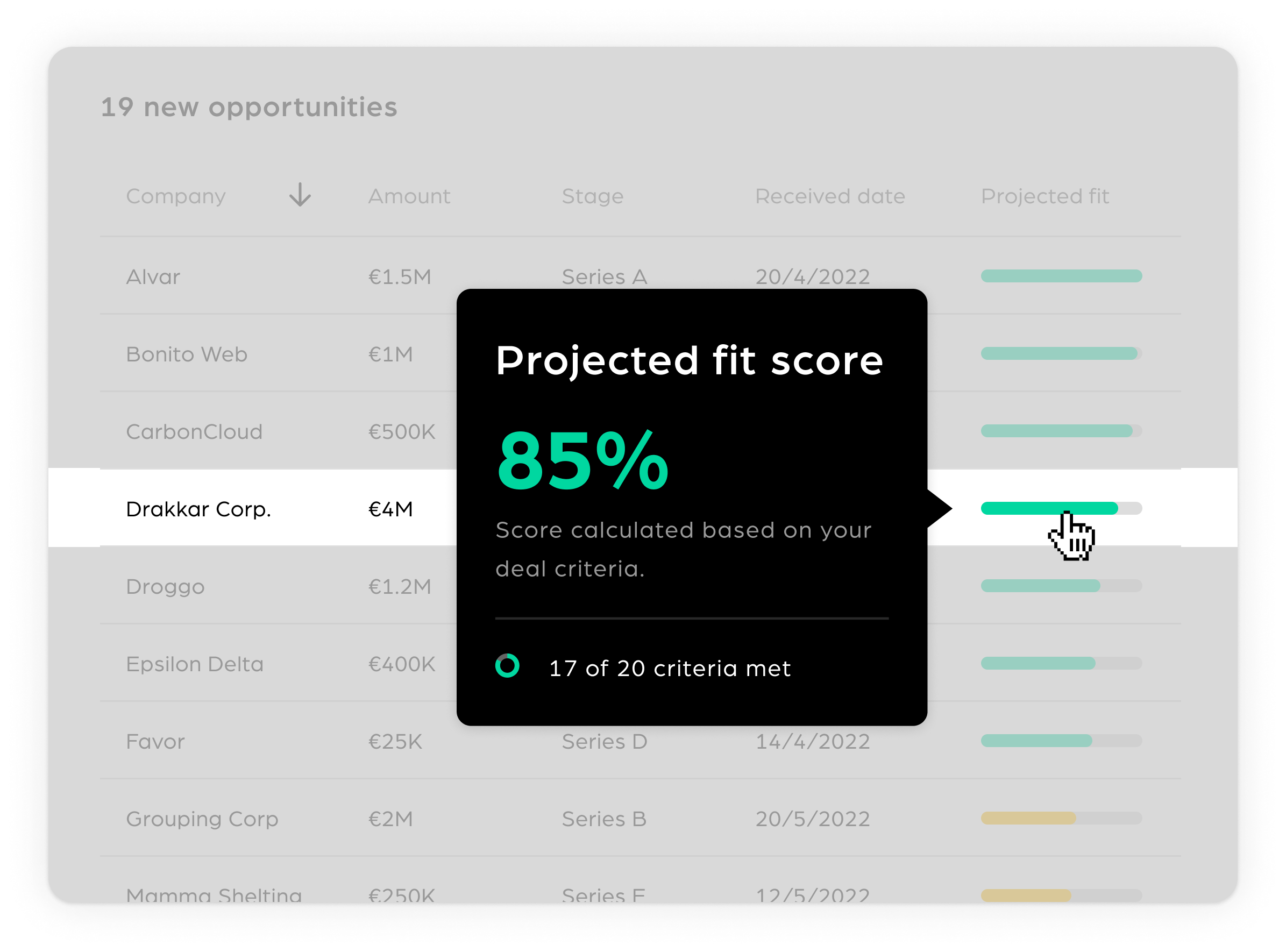

Opportunity score for instant lender matches

Calqulate imports a company’s financial data directly from the bank, payroll, accounting, subscription and payment systems.

We calculate all the financial KPIs that lenders need for instant loan decisions. Calqulate matches the borrower’s financial data against a lender’s deal criteria to help find the most promising matches.

Financial data platform

Calqulate standardizes and refines financial KPIs for small and medium-sized businesses across multiple countries and verticals. A loan applicant can easily share instant financial data to a lender for a closer analysis and a better loan decision.